Find more articles

The results of our Executive Recruitment Survey are in…

Whilst the sample is small in relative terms, the results are all from Barron Williams network of candidates and clients.

Those are the opinions that matters to us most!

The survey has also highlighted some interesting findings, challenged some the preconceptions, so I thought it would be useful to run through highlights from each of the questions in turn.

Present the results but also add a little further insight into why we think certain responses have been selected, maybe compare research from other surveys, and possibly open things up to further questionnaires, discussions and comment from you.

Demographics of our Executive Recruitment Survey sample base

For context, I’ll start with the last 6 questions of the survey as they relate to the demographics of our sample base.

It’ll give you a clear picture of who those who completed our survey are.

Please also note that many of the questions were not compulsory, multiple answered could be selected, and some of the sample may have missed or chosen not to answer, so not all the numbers add up at first glance.

To establish general demographics, we asked: What industry sector do you currently work in? What is your current function/role? Are you a Barron Williams client or candidate? Where do you live? What is your age? and What is your gender?

Gender Split

In terms of gender, our sample was split Male (65%) and Female (34%), with a very small percentage preferring not to say (1%).

That would appear to be similar, if not a little better than the gender split across UK boardrooms.

A report by the Directory of Social Change covered by the Guardian in 2017 highlighted:

“The number of female boards members is on the rise but still a long way from achieving equality with men. And while women’s presence in the boardroom has grown over the past four years, according to our research at the Directory of Social Change, their positions tend to be non-executive and it’s still a rare company that has a female chair or CEO. By looking at company CSR policies and annual reports we were able to determine the ratio between women and men for 399 corporate boards. Analysis of the data shows that the overall percentage of women on boards was around 22%.”

Hopefully, that’s an illustration of a shift towards more females in senior positions, but maybe we’re being a little optimistic?

Age Range

When it comes to age, again our sample base is reflective of UK averages with the largest proportion in the 53-71 age range (53%), followed by 37-52 (42%) and again a small percentage who preferred not to say (5%).

Whilst there are always exceptions to the rule, senior roles should be awarded on ability not age, however, in general at the senior executive level I still feel you need to earn your spurs before you make the step up.

Geographic Split

As a North East based company we weren’t too surprised to see our region top the responses (45%).

The northern bias of our sample base continues with the North West (17%) and Yorkshire & The Humber (14%) the 2nd and 3rd most popular response respectively.

After that it breaks down as London (10%), Overseas (5%), East Midlands (5%), South East (2%) with responses from Scotland, South West and East of England making up the remainder.

I suppose the nice part was to see some of our overseas based clients/candidates taking the time to complete the survey.

We’ve worked on a number of international briefs in Australia and the Far East over the years and that was represented in our sample.

Client vs Candidate?

This one we were a little unsure what the data would tell us.

Of course it is very much reliant on who takes the time to complete the questionnaire.

Would we get a good representative sample of the Barron Williams audience?

Fortunately, the responses in our Executive Recruitment Survey show that the sample is a good representation of our core audience.

Candidates (45%) make up the majority of our sample with Clients (20%) and a small selection who are Neither (3%).

The neither will be a handful of suppliers, consultants and contacts that we work with.

However, delighted to report that the remainder selected being Both Client and Candidate (32%), as we pride ourselves on not differentiating between the two.

We view candidates as potential future clients. We work hard to foster those relationships. It is nice to see that many of those on our network feel the same!

Industry sectors

The final demographic question was again one where we weren’t sure on who would take the time to complete the survey.

We have a clear understanding of which sectors we are most active, however, again we were happy to see that the sample was broadly reflective of our diversity.

Industrial/Manufacturing (37%) was our most popular response, followed by Retail & Consumer (17%), Pharma & Life Sciences (13%), Financial Services (9%), Tech (9%), Government & Public Services (5%) with the remainder selecting Other.

Overall, we were happy and confident that those who completed the survey gives us a true reflection of the current Barron Williams audience.

The advantage of that being that we can look at the following questions and take confidence in the results of the more qualitative questions/data…

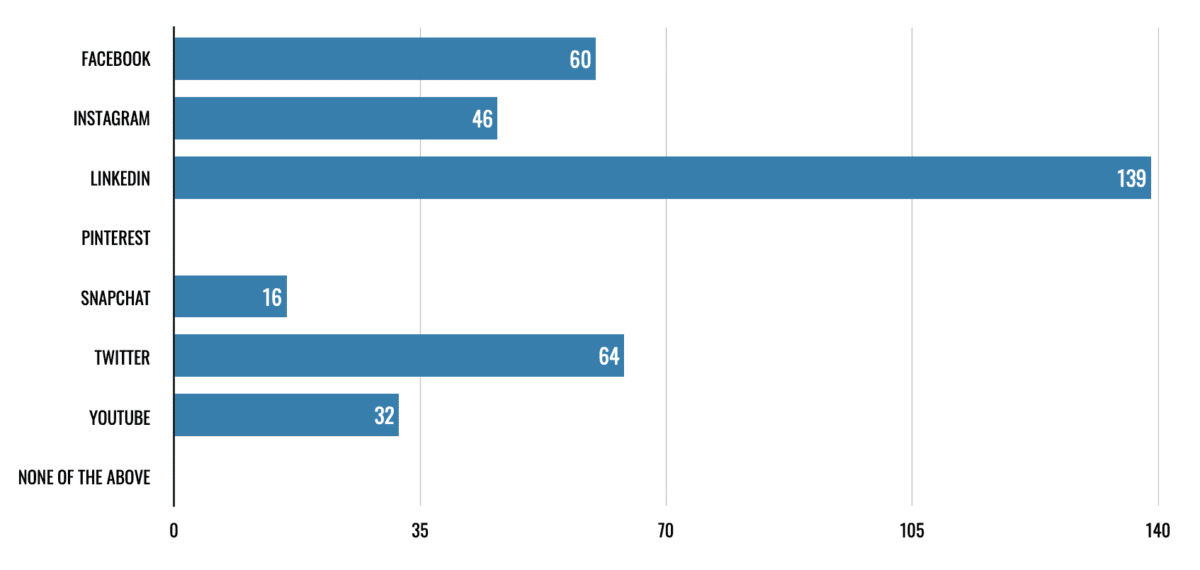

What social media platforms do you use regularly?

I don’t think we were too surprised with this one.

Pretty much everybody who completed our Executive Recruitment Survey has a LinkedIn (139 out of the 150 who completed it).

In modern business, LinkedIn is an essential component, an extension of our CV, and an integral part of our professional persona.

Twitter, Facebook and to a lesser extent Instagram are also used regularly by our audience. However, my view is that these are more for social/domestic purposes.

Interestingly, nobody selected none of the above. That tells me we all use at least one social media platform or another?!

However, that LinkedIn figure also tells me if you haven’t got it at the senior exec level, then maybe you should!

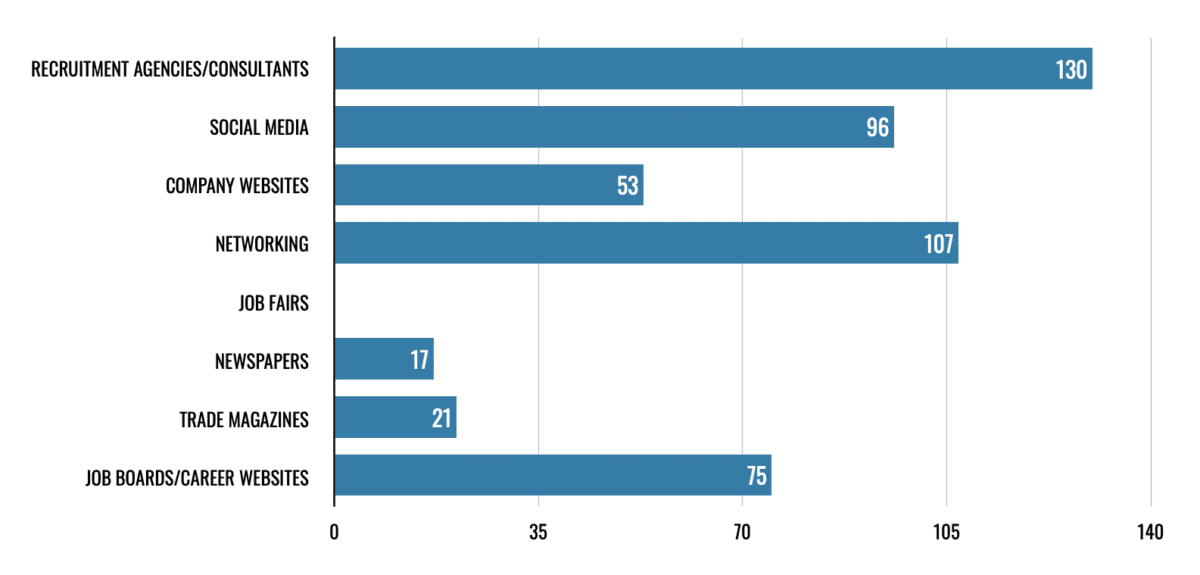

What resources would you use to look for a role?

At the senior exec level we weren’t too surprised to see Recruitment Agencies/Consultants and Networking come out as the primary tools for many when looking for a new role.

However, the popularity of social media in a role search did give us a little food for thought.

At Barron Williams we pride ourselves on making best use of LinkedIn and Twitter primarily, so it is interesting that our clients/candidates feel the same.

I’m pleased to see that more people are focussing on their networks though – Rightly so in my view!

I’m sure this is a subject we will revisit in more detail in the future!

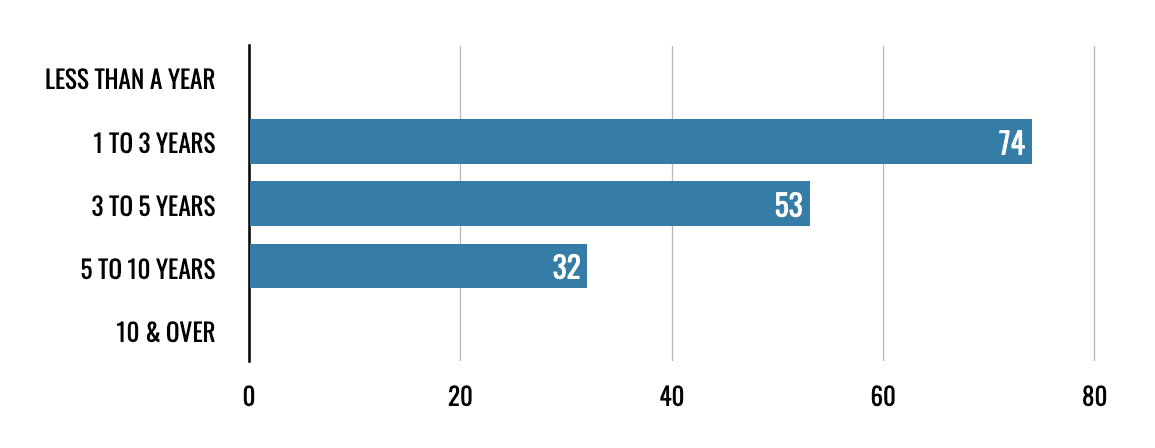

How long would you expect to stay in a role before progressing?

This was another question when we designed our executive recruitment survey where there was uncertainty about what the popular response would be.

At Barron Williams we all felt that the 3 to 5 years would possibly come out on top.

I suppose that’s maybe the ‘safe’ middle answer?

However, at the senior exec level there is clearly a shift towards shorter tenures in roles.

However, it is also worth stressing that we asked how long before you progress in a role. That doesn’t mean leaving a company necessarily, however, it merits further thought.

If we’d asked how long would you expect to stay in a company I’m sure that would have prompted different answers.

The responses to this question raise more questions.

Seeing as many CV’s as we do, their is a lot of evidence that people stay in post and organisations for shorter periods than in the past.

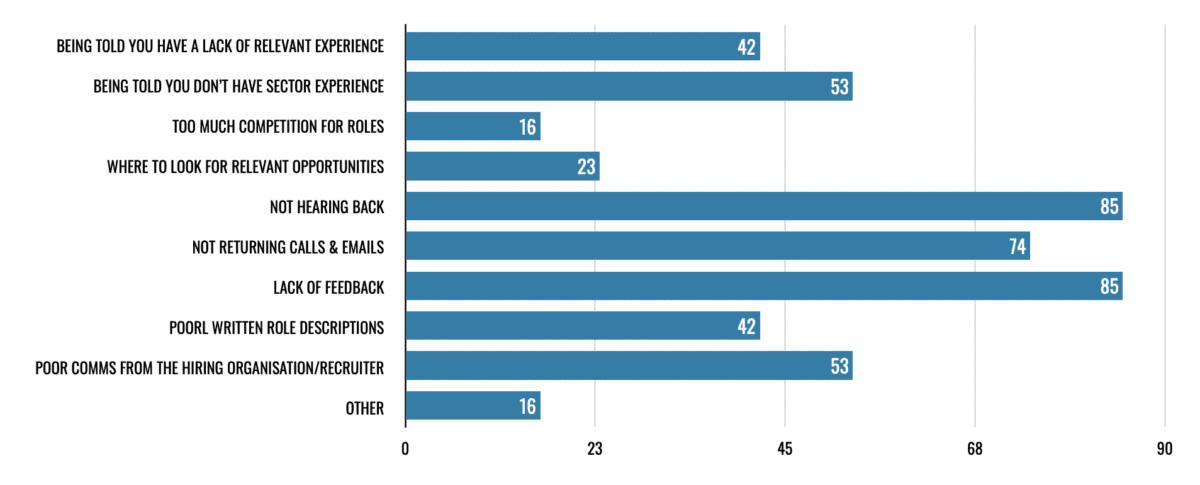

What are your biggest frustrations when searching for a new role?

In terms of frustrations, I don’t think there were too many surprises. This is a topic we’ve discussed in a number of previous articles.

Research into this field often highlights that Not Hearing Back, Not Returning Calls & Emails and a Lack of Feedback as a candidates biggest grievance when looking for a new role.

In When is a candidate a client? we looked at why providing a positive candidate experience was so important.

Quoting from the LinkedIn Talent Trend report we highlighted that:

“Approximately 60% of jobseekers report having a poor experience while applying for work. This negative impression can be a deep and lasting one, with 83% of candidates saying that a poor applicant experience can change their minds about a role or company they once liked.”

In the same article we also stressed that we will always strive for fast return of any phone calls and emails.

Of course this sometimes isn’t possible, always for a good reason.

However, you will always know where you stand at each stage of the recruitment process with Barron Williams!

Rank in order why you would choose to work for a specific company?

Again, there is a quite a lot of information to analyse and digest with this one that we will certainly be revisiting.

As an overview, if we start by looking at what people ranked as the most important, Company Values (32%) and Salary (27%) received the highest number 1 rankings.

This was closely followed with a number 2 ranking for Location (32%) and Benefits Package (20%), though the right package and location is still a prerequisite.

Whilst the popular choices for a 3rd place ranking was fairly evenly split between Location (29%), Salary (21%), Benefits Package (21%) and Company Values (21%).

Areas such as Training Opportunities, Career Progression, Flexible Working and Corporate Social Responsibility all consistently received a lower ranking.

Of course, I appreciate that you aren’t saying these are not important.

It is just we clearly feel the likes of Company Values etc are of more importance when we are looking at taking a role with a new company.

Our experience very much supports this conclusion too.

Rank in order what you think is most important when recruiting a new senior exec?

The flip side of question 5 is what’s important when a client is recruiting a new exec.

The most popular choice for a number 1 rank is Cultural Fit (47%), followed by a well Presented CV (27%).

The choices clicked as 2nd most important were quite evenly split between Graduate Level (or above) Qualifications (20%), Cultural Fit (20%), Longevity in Previous Role (20%) and Personal Fit with the Senior Exec Team (20%).

Those that were ranked as least important included Potential for Future Growth & Development (44%) and, interestingly, also Graduate Level (or above) Qualifications (44%) receiving a high number of 8 ranks.

Another for us to unpick in more detail at a later date!

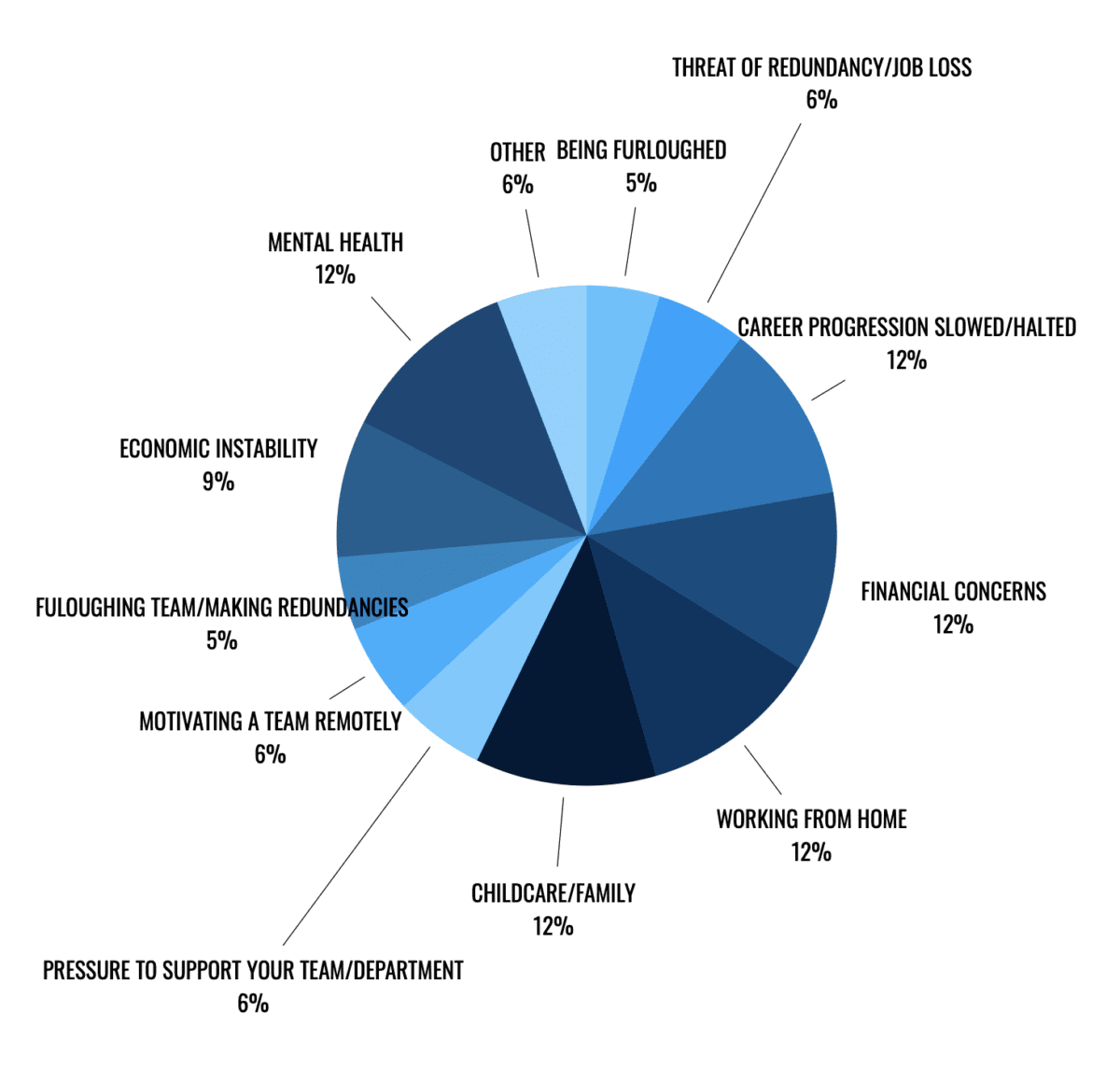

What has had the biggest impact on your professional life/career from COVID-19?

There is simply no getting away from what a truly difficult year 2020 has been for all of us.

We were keen to see what you felt was the most difficult aspect of the COVID pandemic on your professional life/career.

The answers to this question are one we feel will have a significant impact on our business, potentially highlighting ways we can best support our clients and candidates in the coming months and years ahead.

As you can see from the pie chart, there was a broad split across all of the options we provided.

However, with close to half being shared between Career Progression, Financial Concerns, Working From Home, Mental Health and Childcare/Family as those with the biggest level of concern.

One conclusion that we can clearly draw is that this crisis clearly affects us all on a very personal level.

Would some these choices have received a much lower number of clicks if we’d done an Executive Recruitment Survey in 2019?

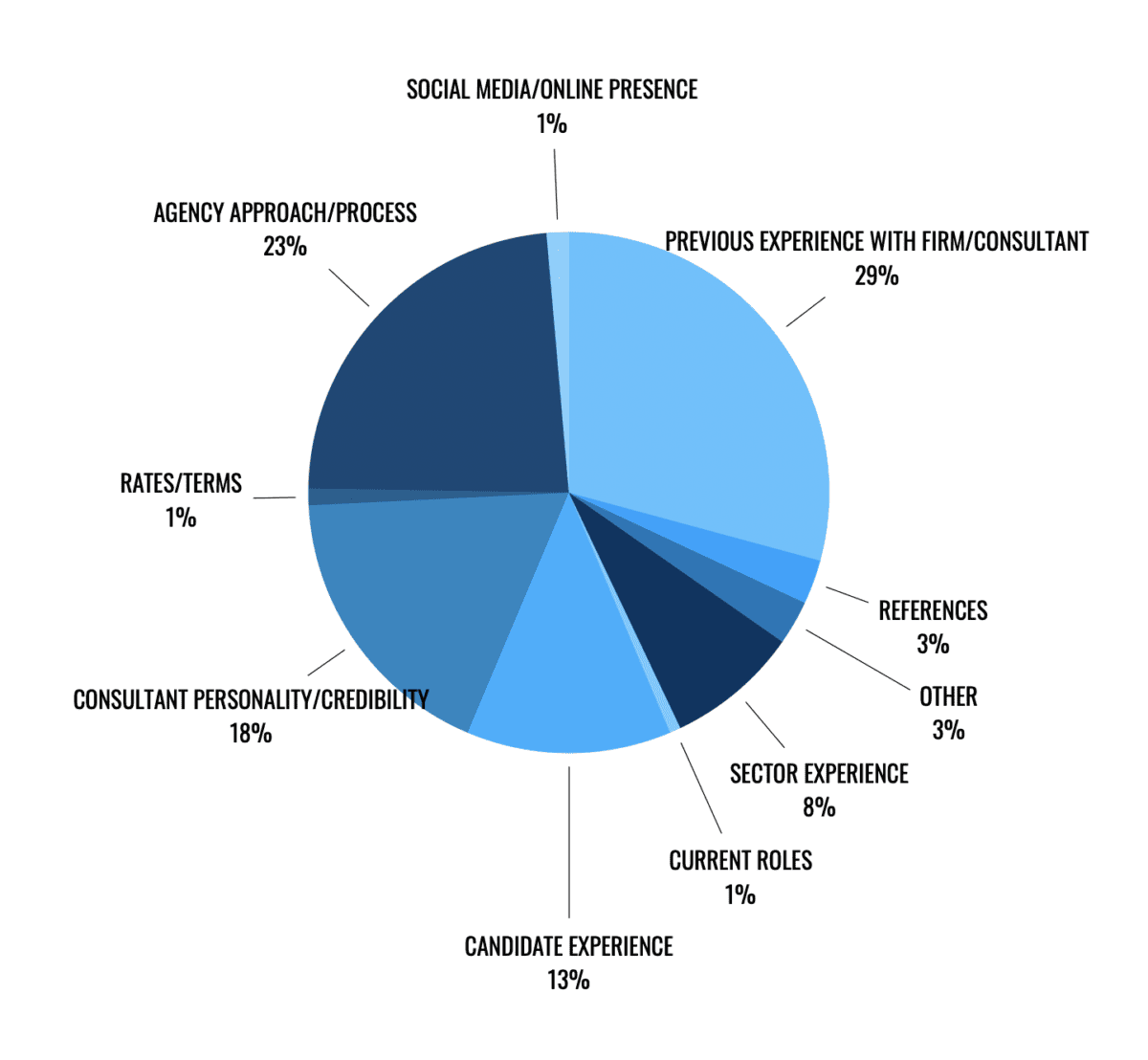

What’s most important now when selecting an executive recruitment/search firm?

We jumped the gun on this one and looked at it in detail in last month’s What’s important when selecting an executive search firm? article…

The results very much support what we say in that article.

And again, as with much of the previous questions, of course all of these things are important.

However, people clearly feel that Previous Experience (29%), Agency Approach/Process (23%), Consultant Personality/Credibility (18%) and Candidate Experience (13%) are what’s most important.

Our challenge is to convince new clients without previous experience.

Some of the things people typed in the Other section included holding a longterm working relationship with the agency/consultant and their level of integrity/trust.

What next with the findings from our Executive Recruitment Survey?

At Barron Williams, this is what we hoped would be the popular choices though…

After all, they form much of the Barron Williams approach to senior executive recruitment.

Fortunately, our survey backs up our understanding of what is important to both clients and candidates.

In summary, as we’ve stated a few times in this post already, moving forward we will definitely look at pulling together some more detailed insights out of this research.

It has been a very interesting and productive exercise.

If you have any further comments or questions regarding our Executive Recruitment Survey, please don’t hesitate to get in touch via email or our social media channels.

Also, thank you to all of you who took the time to complete the survey. It is very much appreciated!

If you’re looking for a senior executive for your organisation, please use our Client Upload Form or Call Us now.

If you’re looking for your next role, then please feel free to Upload Your CV or Call Us for an exploratory conversation.